This paper investigates how fluctuations in currency value affect investment in Sub-

Saharan Africa (SSA). While the existing literature focuses on foreign direct investment,

this study extends the analysis to domestic, private, and public investment. I use

panel data of 27 currencies used in 36 SSA countries, with the baseline analysis covering a

period from 1999 to 2017. I address endogeneity issues by using two-stage least

squares instrumental variable (2SLS-IV) identification strategy, in which a country’s

exchange rate regime is an instrument. I find that exchange rate volatility positively

affects foreign direct investment inflows and adversely affects both domestic and public investment.

The findings also highlight the critical role of institutional quality and

openness to trade in attracting investment in Sub-Saharan Africa.

See More

Electricity and Employment Diversification:

Evidence from sub- Saharan Africa.

Technology and Labor Market (Econ 0478),

Noe Vyizigiro; May 15, 2024

This study examines the impact of electrification on employment diversification across

the agriculture, service, and manufacturing sectors, with a particular focus on sub-Saharan

African Countries (SSA). Motivated by the persistently low electrification rates in many

SSA countries, I investigate whether electrification drives shifts in employment patterns

and whether its effects are amplified in countries with lower baseline electrification. Using

OLS, with a panel data for 66 countries from 2000 to 2019, I find that one percentage-

point increase in a country’s electrification rate reduces employment in agriculture by

0.33 percentage points, while employment in other sectors increases. Subgroup analysis

of SSA and non-SSA countries reveals no significant divergence, except for manufactur-

ing in SSA, where electrification appears to have a negative effect—though this result

is inconclusive due to the potential omitted variable bias. These findings suggest that

increasing electrification rates plays a crucial role in creating jobs and transitioning sub-

Saharan African economies away from subsistence agriculture toward more diversified and

productive economic activities.

See More

What are the factors associated with longer life expectancy

across low- and middle-income economies in Africa and South Asia?

Regression Analysis Final Paper by,

Noe Vyizigiro & Liza; May 22, 2023

In both developed and developing countries, life expectancy has been used not only as an indicator of mortality but also as an economic development indicator.

Life expectancy has increased dramatically over the past few decades. Demographic studies indicate that no country in the world had a life expectancy longer than 40 years

in the 19th century, and the entire world was living in extreme poverty (Roser et al. 2013). There has been an opposite trend in global poverty rates and life expectancy.

The World Bank indicates that only 9.2% of the world's population lives in extreme poverty today, living on less than $2.15 per day (World Bank: 2022). At the same time,

a significant increase in life expectancy has occurred with the decline in poverty rates, ranging from 30-40 years in the 19th century to 45-85 years in 2005 (Riley:2005).

Countries with low life expectancy tend to be in extreme poverty. However, the poorest countries in the world are not necessarily the ones with the lowest life expectancy.

Additionally, economic growth does not necessarily translate into high life expectancy growth today. Some countries, for example in Sub-Saharan Africa, with the fastest

growing economies, are experiencing a decrease in life expectancy (Shahbaz et al.2015)

This study examines the factors associated with higher life expectancy in low- and middle-income countries in Africa and South Asia based on recent data collected from 2009 through 2019.

Since a number of studies have been using data collected in the past decades, it is important to use novel data to examine what relevant factors determine life expectancy today, which will

help in deciding what pertinent factors to prioritize. Our goal is to determine the relevant policies to improve longevity in low- and middle-income countries in those regions.

See More

Beyond Resource Curse:

Challenges and Opportunities for the Democratic Republic of

Congo’s Economy.

*Noe Vyizigiro

B.A. in Economics, Middlebury College, Middlebury, VT.

Email: noevyizigiro8@gmail.com

ECON 0234/Economics

of Africa. Prof. Obie Porteous. May 19th, 2023

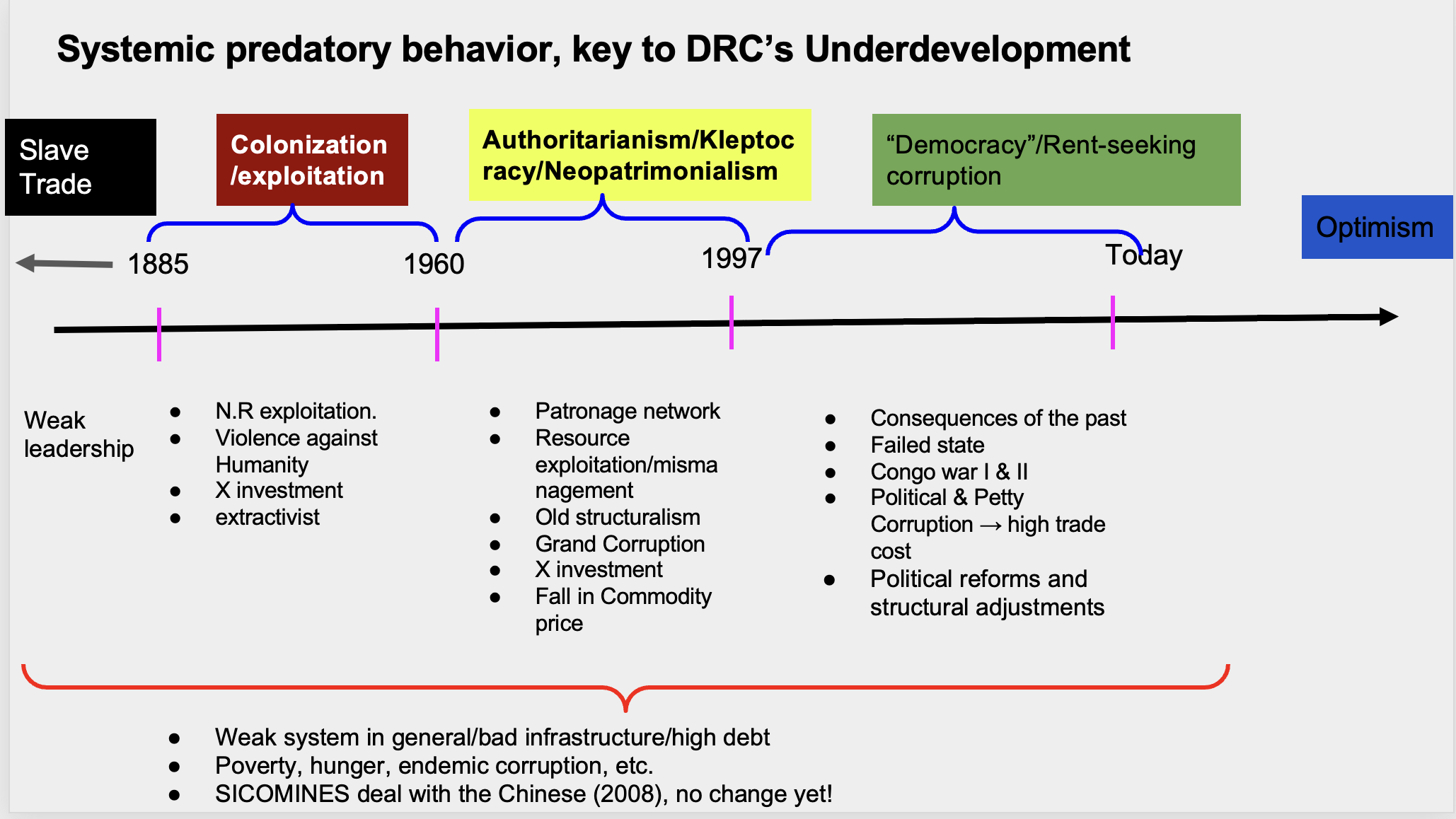

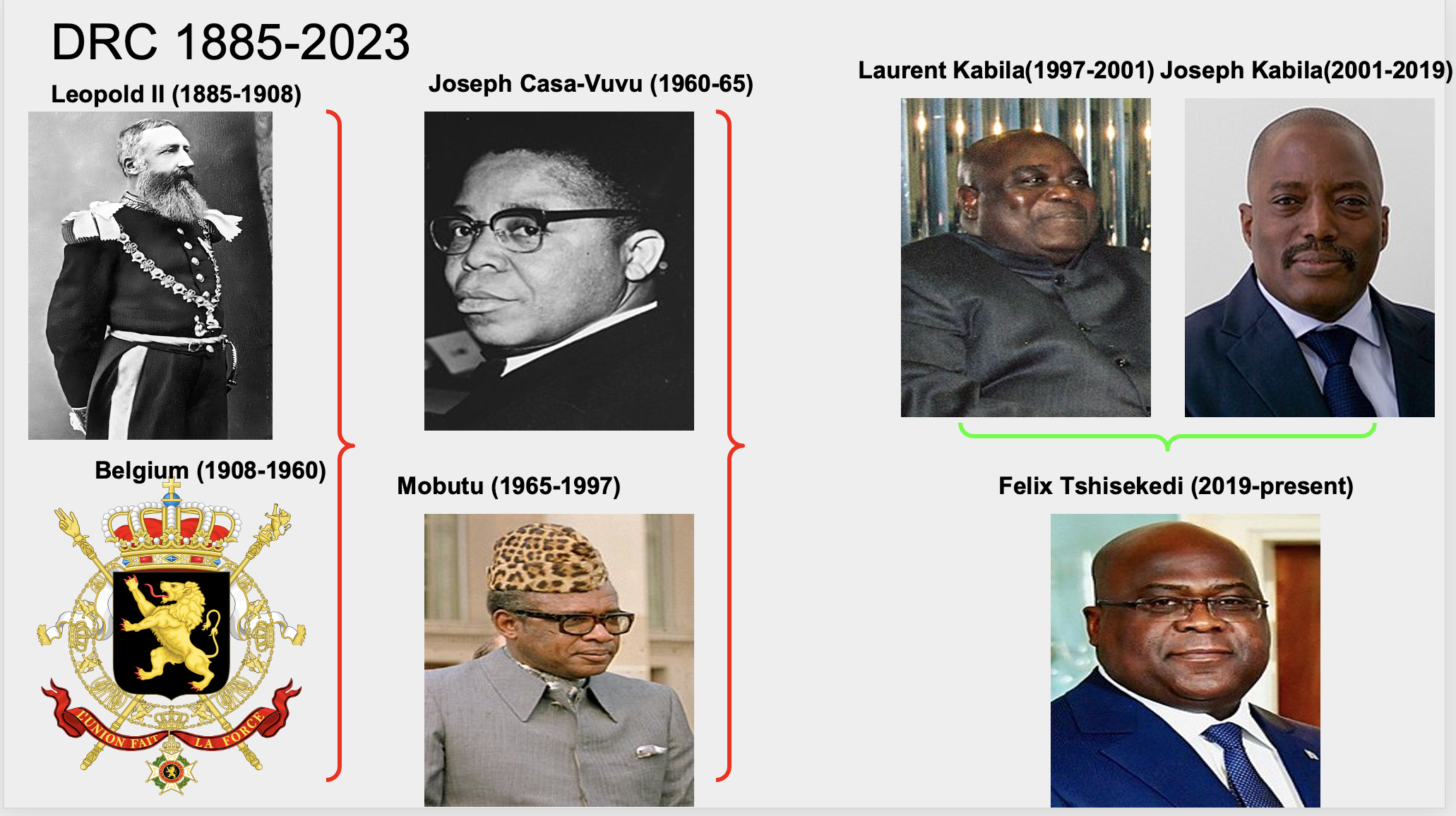

Despite its rich natural resource base, the Democratic Republic of the Congo ranks among the world's least developed countries. A complete attribution of this underdevelopment to the notion of the resource curse, which is characterized by rent-seeking corruption, price volatility, and the Dutch disease, fails to recognize other factors that have affected both the economy and the workforce. This paper acknowledges DRC as an excellent example of the resource curse concept but emphasizes DRC’s structural deficiencies resulting from colonialism and slavery, such as poor governance, insufficient transportation networks, a lack of value-added economic infrastructure, and a shortage of skilled labor. Although the DRC has a long history of exploitation, it still maintains significant sources of revenue, which continue to be impacted by insecurity, poor management, and predatory cultures. This paper suggests that the development of an effective governance system is essential to prioritizing initiatives that will enhance the DRC economy. In addition to reforming the political system, the government must invest mineral revenue in agriculture, infrastructure, energy, and quality of labor to increase capital accumulation. The country will therefore transition from a handicraft economy to an industrial, manufacturing economy, with a corresponding increase in output and productivity as a result. See More

this is the paragraph1

this is the second paragraph about this picture